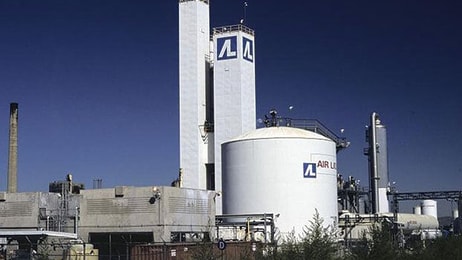

Go-ahead given: Path cleared for Air Liquide’s acquisition of Airgas

Air Liquide has announced that the US Federal Trade Commission (FTC) has cleared the company’s acquisition of Airgas, satisfying the final regulatory condition to the closing of the acquisition.

The companies now anticipate closing the acquisition on 23rd May (2016), subject to the satisfaction of any remaining customary closing conditions.

FTC clearance is subject to certain conditions that Air Liquide has agreed to undertake, including the sale of certain assets, all of which are to be satisfied following the close of the acquisition. A divestiture package has been prepared and the divestiture process is well underway.

... to continue reading you must be subscribed