Air Liquide and Airgas: The divestments in detail

In the wake of Air Liquide achieving the final go-ahead from the Federal Trade Commission (FTC), to acquire Airgas, gasworld Business Intelligence discusses the impact that the required divestitures will have on the US industrial gases market.

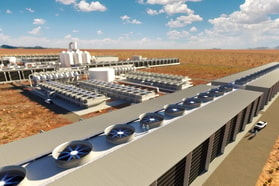

Air separation units

According to the FTC, 17 ASUs (in 16 locations) will need to be divested, of which 13 are currently owned by Air Liquide, and the remaining four owned by Airgas. It is understood that 11 of these plants (nine Air Liquide, two Airgas), supply customers onsite, as well as producing liquid product for the local merchant markets. All onsite and bulk contracts associated with the respective ASUs, will also be transferred to the eventual buyer of the assets – this process will also require FTC approval and must be complete within four months of Air Liquide closing on the acquisition.

... to continue reading you must be subscribed