Air Products reports Q4 and full year 2021 results

Air Products CEO Seifi Ghasemi said the company has delivered excellent results for the year, despite significant external challenges, as the industrial gas giant today (4th Nov) reported its fiscal year 2021 results.

“The committed, dedicated and motivated team at Air Products proved once again that they can delivered results now while developing and executing megaprojects for profitable growth in the future.”

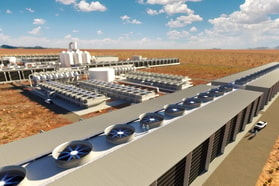

“We delivered excellent results for the year, despite significant external challenges. We announced significant projects across our core gasification, carbon capture and hydrogen growth platforms, including the net-zero hydrogen facility in Alberta, Canada and the massive blue hydrogen project in Louisiana, while also closing on the $12bn Jazan acquisition.”

For the year, Air Products reported GAAP net income of $2.1bn, up 10% over the prior year.

... to continue reading you must be subscribed