An Industrial Gas Industry Perspective on LNG 17

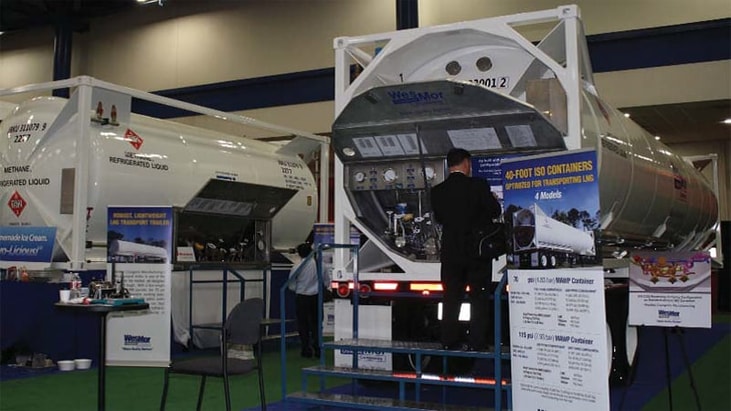

The 17th International Conference & Exhibition on Liquefied Natural Gas (LNG 17) was held in Houston, Texas this year and I had the opportunity to attend. This year’s event represented an evolution in the LNG series, with key sessions focused on the strategic, commercial, and regulatory issues of LNG in addition to the traditional display of production, technology, and distribution developments.

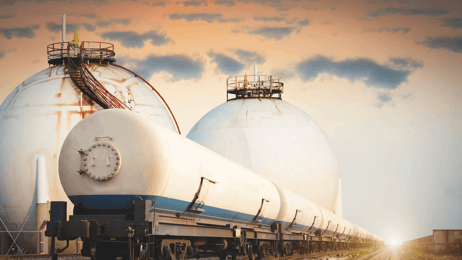

On the opening day, delegates heard from the representatives of two governments— the US and Australia. Both countries are looking to become major new exporters of LNG, which will have an impact on the dynamics of the world LNG market, particularly as demand from Asia increases.

One of the signals of the increased momentum of LNG developments in the world’s energy scheme was the participation of the major international Oil & Gas companies. The inaugural Global Strategy Forum, also held on day one of this event, gave two super majors—Chevron and ExxonMobil— the platform. These companies view supply issues, like meeting future demand for gas, LNG project lead times, and the regulatory environment in importing and exporting countries, as being the biggest issues of the day. In addition to Chevron and ExxonMobil, Shell, Conoco Phillips, Rasgas/Qatar Gas, Sonotrach, and Gazprom also had a presence at this year’s event with major exhibits that described their operations and plans.

On day two of the conference, leading industry analyst Daniel Yergin of IHS presented a different perspective. He identified demand as the main constraint for the LNG industry going forward, rather than supply. Yergin believes that prices at the Henry Hub will become the benchmark for world prices. (The Henry Hub is a major distribution pipeline owned and operated by Sabine Pipe Line, LLC, a wholly owned subsidiary of ChevronTexaco. In the absence of “real-time” wellhead natural gas prices, market participants have adopted Henry Hub spot and futures prices as a surrogate measure for the current wellhead price, because they are reported on a daily basis by several natural gas industry news publications. eia.gov.)

... to continue reading you must be subscribed