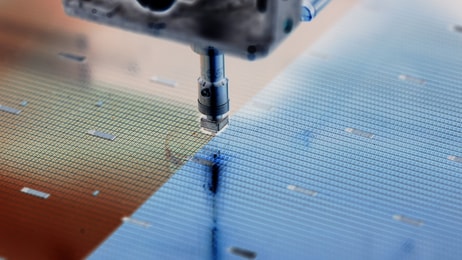

Asian semiconductor industry emerges from recession

Asian memory chipmakers are expected to post another set of quarterly losses soon, on weak consumer demand for personal computers and electronics – yet signs point to steady improvements over the remainder of the year.

The downturn, which started in early 2007 and was compounded last year by the global economic slump, has claimed a heavy price from every manufacturer and has triggered a wide-ranging restructuring process in the industry.

But analysts now appear to see a faint light at the end of the tunnel.

$quot;The long down-cycle in the semiconductor industry may be coming to and end,$quot; Peter Yu, an Analyst at BNP Paribas is quoted as saying.

... to continue reading you must be subscribed