Belief in the Ladder of success

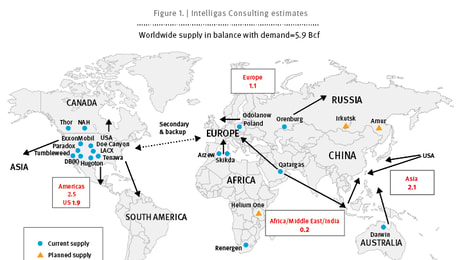

Durell Johnson’s career has come full circle. Twenty years after ending his association with the Ladder Creek Helium Plant, Johnson began 2020 as its new owner. Far from seeing it as a sentimental step back, Johnson has returned to complete a vision of making Ladder Creek one of the most significant sources of helium in the US.

“I wanted come back and finish what I started,” Johnson told gasworld.

“So, when the opportunity came up last year to acquire the plant, I jumped at it because I really believe in the tremendous growth potential that Ladder Creek represents for the region’s gas producers and for US helium supply. The helium resource is here, but in the past 23 years it has not been exploited or developed to anywhere near its full potential. I wanted to come back and prove that we can turn the Ladder Creek plant and the surrounding gas resources into one of the top helium-producing resources in the US.”

... to continue reading you must be subscribed