Changing helium landscape: insight from MATHESON, IACX, NAH, Arencibia, Cryofab

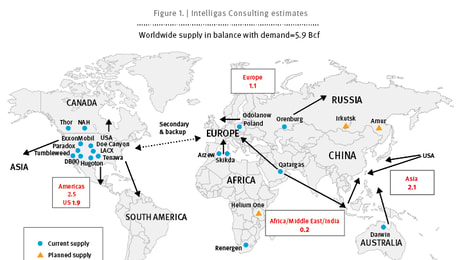

Coronavirus (Covid-19) has changed our lives and disrupted business, shifting demands since the start of the global pandemic in March. Helium entered 2020 in short supply, but has the impacted of Covid-19 changed the supply-demand balance? And what is driving demand?

To gain some insight on the global helium supply-demand situation, how the market was impacted by Covid-19, gasworld asked an industrial gas major, smaller helium producers and established helium equipment manufacturers for input. Those featured here are:

Steve Eckhardt, Vice-President, Global Helium at MATHESON Tri-Gas, the US subsidiary of Nippon Sanso Holdings (formerly TNSC) which supplies bulk liquid helium ISO containers to customers around the world. MATHESON sources helium from the US, Middle East, and Europe and will source helium from east Asia in the future. MATHESON supplies helium in tube trailers, cylinders and liquid dewars from multiple locations across the US.

... to continue reading you must be subscribed