Chart’s Meteoric Rise

gasworld talks to the President of Chart Asia, Eric Rottier, about the company’s rapid growth in China

Chart Asia started out when the Garfield Heights, Ohio, US-based Chart Industries Inc. acquired Johnson Engineering Pty Ltd. near Sydney, Australia to capitalise on large cryogenic tank and trailer demand in Asia in 1996. In the same year it also acquired BOC’s equity stake in a cryogenic tank joint venture in Zhangjiagang, China to supply standard cryogenic customer stations to the Chinese market.

Moving forward, 2001 saw Chart Cryogenic Equipment (Changzhou) Co. Ltd. established. This was a wholly foreign owned entity with a mission to supply liquid cylinders, vacuum insulated pipe, LNG vehicle tanks and helium dewars to the Asia market. This was followed in 2004 by Chart Cryogenic Engineering Systems (Changzhou) Co. Ltd, another wholly owned foreign entity, to supply large cryogenic tanks, lorries, trailers, and vaporisers for the Asia market and as an integration platform for the other facilities.

In 2005 Chart acquired Changzhou CEM Cryo Equipment Co. Ltd, a market leader in China for cryogenic lorries and delivery units as well as a respected supplier of standard and engineered bulk storage tanks. The acquisition provided significant scale for Chart in Changzhou and expanded capacity, as well as adding over 180 skilled employees to the Chart team, which provided a strong foundation for growth. As part of the agreement, Melbourne-based CEM International became Chart’s sales agent for Australia and New Zealand. “The local presence and capabilities of CEM International, combined with Chart’s investments in China, allowed us to capture a large portion of growing LNG and Industrial Gas demand in Australia and New Zealand,” says Eric.

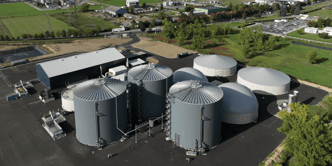

This growth period also included the completion of a facility expansion in Changzhou, followed by the establishment of a commercial office in Shanghai in 2006. In 2007 Chart established Chart Cryogenic Distribution Equipment (Changzhou) Co Ltd, a joint venture to supply cryogenic trailers to the Chinese market. Phase two of the expansion in Changzhou means that Chart now boasts a 23-acre production site and over 30,000m2 of covered production space. All of the company’s China operations are now consolidated at this single campus.

The company’s vision is to be the leading designer and manufacturer of cryogenic equipment, consistently delivering innovation, quality, service, and value to Chart customers.

To get to this leading position, the company works on product innovations that offer a superior competitive advantage to its customers, while becoming a prominent global provider of application-based cryogenic solutions that set industry standards for quality, service, and value. It also strives towards an employee culture of pride and commitment to growth, and healthy long-term business partnerships with customers and suppliers.

Rottier says that in support of these goals, Chart has invested in facilities and manufacturing equipment in China that are on par with the best in class globally, “We maintain safety and environmental standards equivalent to Europe or the US, and we invest heavily in employee training.”

Specific examples of success include localising Chart’s proprietary MicroBulk product lines (ORCA and Perma-Cyl®), its Trifecta® high pressure gas delivery system, liquid cylinders, ultra high purity electronic grade bulk tanks, vacuum insulated pipe, helium dewars, engineered bulk tanks up to 500,000l, and trailers for export around the world. “These product lines differentiate Chart and they have experienced significant growth while the 50 or so other competitors in Asia mostly fight over commodity product lines.”

Export markets

Over 50% of Chart Asia’s output is exported to South East Asia, Australia, the Middle East, South America, and the US. “The most significant end-uses for our products include electronics, steel production, LNG, glass, chemicals, metal fabrication and healthcare,” Rottier explains. The major gas companies represent the majority of Chart Asia’s demand. “We service the major gas producers with local account managers, regional executives, and global key points of contact at their corporate offices,” he adds. These relationships are further enhanced with Chart’s local agents and Chart Asia Authorised Service Providers. Several of the majors are driving towards global specifications and supply agreements. “Chart is positioned well to meet their global and regional needs given our distribution and storage manufacturing infrastructure in China, the Czech Republic, and the US.”

Chart’s business model encourages collaboration of experience and expertise regardless of the business unit involved. Chart Asia was established as a platform for organic growth and it provides resources to facilitate growth in the Pacific Rim region regardless of the internal organisational structure within Chart.

A good example of this collaborative approach is illustrated by Chart Asia currently working with the Energy & Chemicals Group to add brazed aluminium heat exchanger capabilities in China. These additional capabilities will enhance Chart’s ability to service the Chinese and Asian industrial gas and hydrocarbon markets.

Out of Asia

Emerging growth areas to watch include laser cutting and high-pressure gas applications, bulk CO2 beverage carbonation for fountain drinks, enhanced oil recovery, stem cell research, and distribution of LNG, Rottier suggests. “LNG is being pursued as both a vehicle fuel and a heating source for industrial applications,” he says. In areas where there is no natural gas pipeline, LNG can be distributed via a ‘virtual pipeline’ consisting of trailers and bulk storage/vaporisation systems at the end user’s site.

Mode change is driving gas distribution’s continued evolution in Asia. Historically, there was a large gap between high-pressure cylinders and bulk delivery of gas. “We have experienced an aggressive shift to liquid cylinders and most recently MicroBulk,” says Rottier. “We expect this trend to continue as the cost of distribution escalates. We also see a growing demand for weight-optimised super insulated trailers for the same reason.”

... to continue reading you must be subscribed