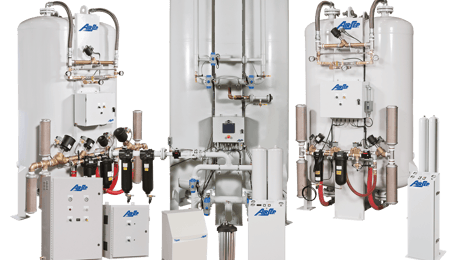

Chart’s critical care products up by 34%

Orders for Chart Industries’ medical oxygen critical care products increased by 34% in the first quarter (Q1) of 2020 over Q1 2019 due to demands caused by Covid-19.

Chart increased associated production by over 50% to meet continued demand for liquid oxygen for Covid-19 patients, according to the cryogenic equipment manufacture’s 2020 first quarter results (ended March 31, 2020).

All Chart manufacturing locations globally have been deemed essential business by each local and federal government and therefore continue to operate under this status.

... to continue reading you must be subscribed