China’s Market for Cryogenic Equipment: Trends, Drivers, and Inhibitors

China’s market for cryogenic equipment is in its early stages of development, spurred on by investments in the country’s liquid natural gas (LNG) handling capacity and the general expansion of its industrial base. While LNG is China’s most high-profile application for cryogenic equipment, it is not the only one. A number of other markets, with wide customer bases, have also flourished in recent years.

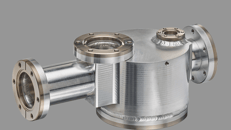

China’s market for cryogenic equipment is in its early stages of development, spurred on by investments in the country’s liquid natural gas (LNG) handling capacity and the general expansion of its industrial base. While LNG is China’s most high-profile application for cryogenic equipment, it is not the only one. A number of other markets, with wide customer bases, have also flourished in recent years. By value, roughly 95 percent of cryogenic equipment falls under one of four product categories. The largest type by revenues are storage tanks, which are made from carbon steel, nickel alloy, and prestressed concrete; second largest are cryogenic valves, which are made from austenitic stainless steel and copper alloy; third, vaporizers, made from high-tensile stainless steel; and finally, pumps, which are typically centrifugal or reciprocating and are made of austenitic stainless steel and specialized plastic sealants. Other parts of a cryogenic system include the pipes and flanges. A typical system configuration for 200 cubic meters of LNG will have one tank, around 15 valves, one pump, and one to two vaporizers.

The Market at a Glance

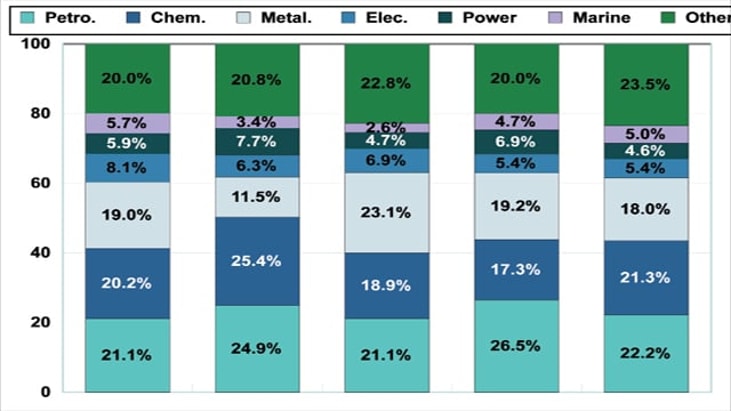

An estimated 11,000 cryogenic systems are currently installed in China, varying from the large LNG systems described above, to small tool treatment systems. In monetary terms, the petrochemicals and power sector makes up around 30 percent of total domestic demand for cryogenic equipment, an estimated USD 650 million for 2010. Other markets include chemicals (where cryogens like nitrogen are used in fertilizer production), metallurgical applications, electronics, and shipbuilding. Growth in these industries has been strong and is driving nominal expansion of around 10 percent per year for cryogenic equipment. The metallurgy sector, growing at around 30 percent per year, stands out as a key source of future opportunities.

An estimated 11,000 cryogenic systems are currently installed in China, varying from the large LNG systems described above, to small tool treatment systems.

These high growth rates also reflect the relative infancy of this market. A handful of State Owned Enterprises (SOEs) and SOE spin-out companies, which boast high volumes and uneven quality, compete with foreign companies that occupy much of the high-end in China. Foreign companies are often the “go-to” parties for the high performance cryogenic equipment, particularly pumps and valves. But foreign and domestic products are not highly differentiated in the eyes of all customers. China’s regulators, anxious not to hurt nascent domestic players, have yet to enforce a universal set of product standards.

... to continue reading you must be subscribed