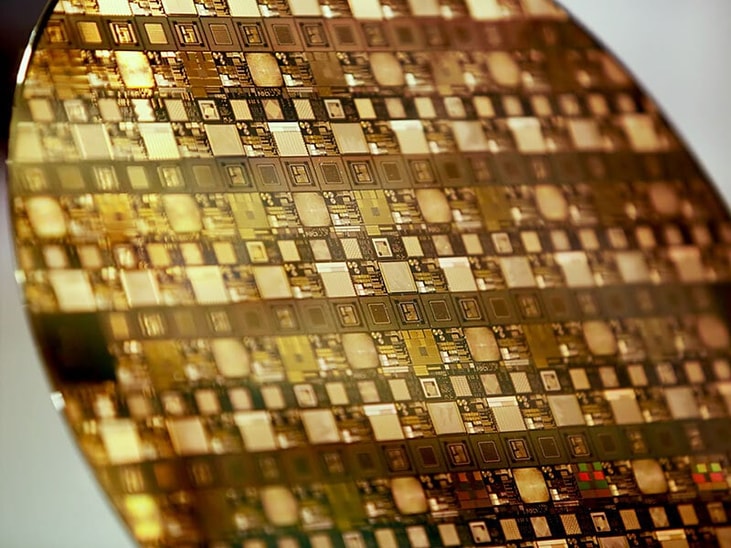

Excimer laser sales grow as worldwide supply of neon stabilises

The number of excimer laser units sold for use with semiconductor lithography started to show steady growth last year due to the recovery in neon (Ne) supply.

As large amounts of neon (Ne) are consumed for lasers to oscillate, the excimer laser unit market became transiently sluggish due to the worsening political situation in Ukraine – which holds a large market share for Ne.

However, with producers promoting greater gas efficiency and the expansion of support setup, there was a turnaround in the trend leading to an increase in sales.

... to continue reading you must be subscribed