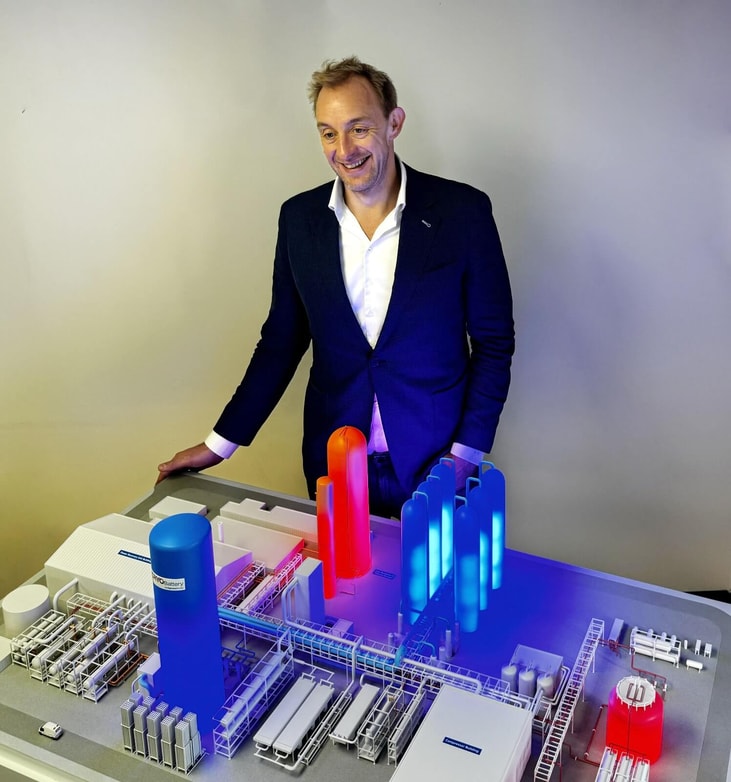

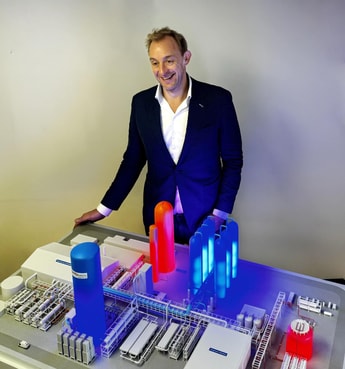

CEO interview: Highview Power’s vision for cryogenics and the grid

Today’s energy grids rely on gas turbines to keep them stable, but the promise of tomorrow is that cryogenic liquid air could deliver a similar capability. Christian Annesley met Richard Butland, CEO of Highview Power, to find out more

As the energy transition builds, and renewable energy grows in the mix, the question of how to store electricity most effectively for grid flexibility has been climbing the agenda. Gas-fired power plants are the most common fast-response option of choice today, increasingly allied to lithium-ion batteries to manage short-duration balancing challenges.

But it is well understood that another piece in the puzzle is needed in the form of low-carbon long-duration energy storage. This means large stores of low- or zero-carbon energy that can be accessed and used from four to up to 20 hours at a time, and sometimes even longer.

... to continue reading you must be subscribed