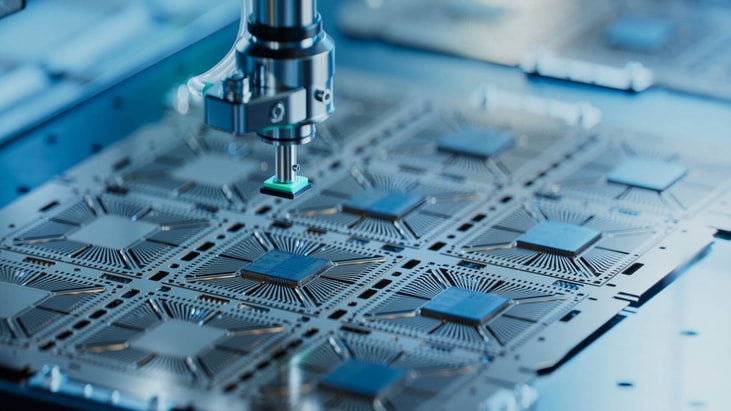

Gases demand in electronics production

It has been a bumpy ride of late in the semiconductor industry, with supply chain disruptions that started with the pandemic in 2020 still rippling through the industry in 2023.

The situation has been exacerbated by myriad recent geopolitical uncertainties slowing down an expected bounce back. Chip-making remains, however, a major consumer of high-purity gases in manufacture processes, and the overall direction of travel is definitely up. Why? Simply because, more than ever, the world today runs on silicon chips. Slowdowns are therefore driven by uncertainties and logistical bottlenecks rather than any lack of demand.

Linx Consulting’s Mike Corbett, updating delegates at the Helium Super Summit in Houston, set the scene by noting first that the volume of silicon (a two-dimensional measure of semiconductor production) would be something like 8% down in 2023 compared with the prior year. But production should then climb again in 2024 by 11% and then by 10% in 2025, suggested Corbett, citing Hilltop Economics.

The figures broadly chime with the full-year figures put out in Q4 by SEMI, the world’s leading microelectronics industry association. SEMI has said global shipments of silicon wafers are on course to decline 14% in 2023, to 12,512 million square inches (MSI). This is down from the record high of 14,565 MSI in 2022. SEMI’s projection for 2024 is for an 8.5% climb to 13,578 MSI of silicon wafers produced.

... to continue reading you must be subscribed