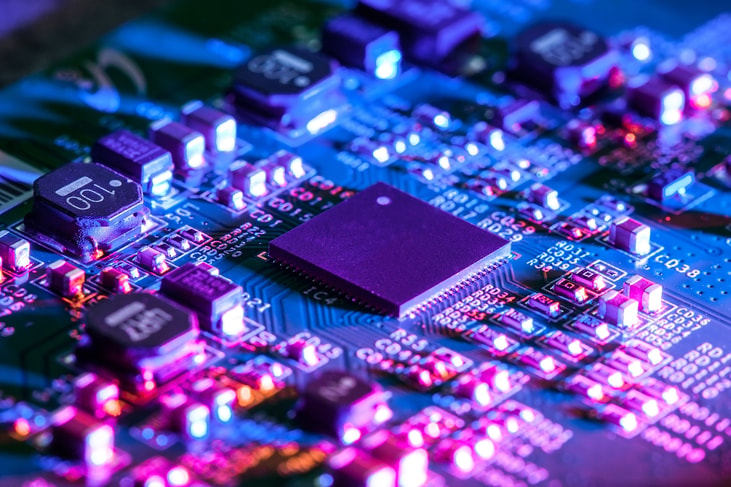

Gases take on a new look with ultra-multi-layer 3D-NANDs

3D-NAND flash memory devices (hereafter, called 3D-NANDs) are at the centre of still competition in creating more layers, according to The Gas Review.

This is having a large influence on the specialty gas market, including the application of new gases, such as tungsten hexachloride (WCI6) and sulphur dioxide (SO2).

Increased competition in increasing the number of layers including Samsung at 64, SK Hynix at 72 and Toshiba at 96 layers

... to continue reading you must be subscribed