Global Economic Turbulence Rattles Latin America’s Strong Industrial Gases Market

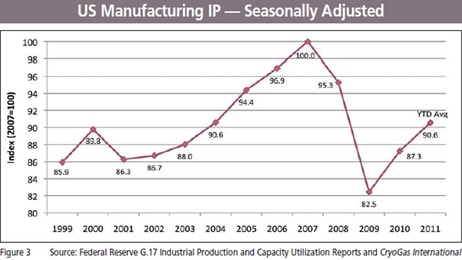

The world economy is fraught with uncertainty due to the continuing European debt crisis, and the recovery in the United States, Latin America’s important trading partner, remains stubbornly mild. These unfavorable foreign economic environments are beginning to affect financial markets and commodity prices in Latin America.

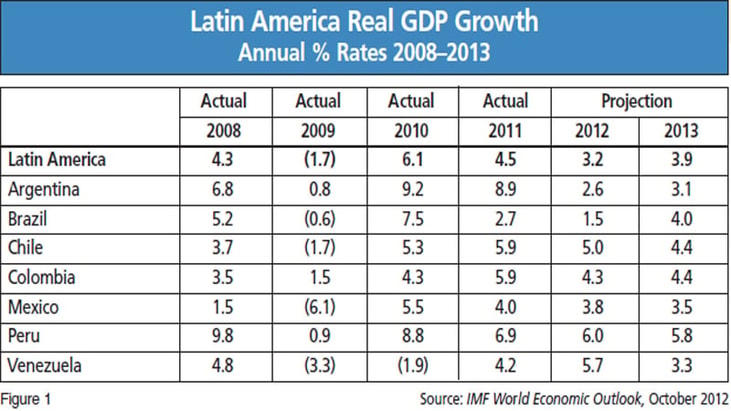

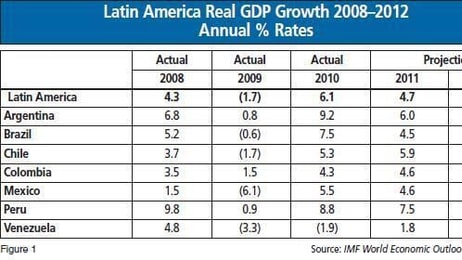

There are already some signs of 3Q 2011 deceleration in Brazil, which has the region’s largest GDP, and in other countries. The International Monetary Fund’s (IMF) most recent review (World Economic Outlook, September 2011) reports that Latin America will continue growing, but at a slightly slower pace than anticipated in its April 2011 projection.

Helped by high commodity prices, favorable terms of trade, and low international interest rates, Latin American economies grew strongly in the first two quarters of 2011, and local currencies appreciated, especially in Brazil. The third quarter brought signs of deceleration, especially in some export markets, and a negative flow of capital to the region, as the world economy felt the effect of the unstable situation in Europe.

... to continue reading you must be subscribed