Helium and rare gas concerns are real: 2022 CMC Conference recap

On April 28-29, TECHCET, the electronic materials advisory firm providing business and technology information, held its highly successful and well-attended 2022 7th Annual Critical Materials Council (CMC) Conference in Chandler, AZ.

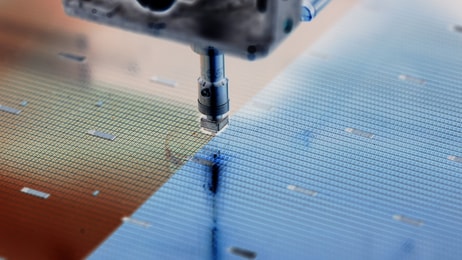

This was an appropriate location with major semiconductor manufacturers Intel and TSMC building manufacturing facilities in the area.

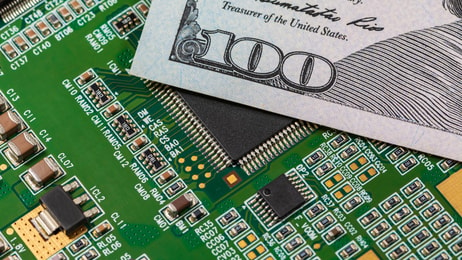

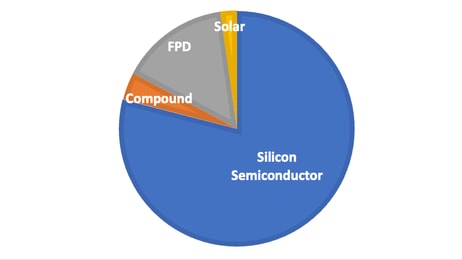

Over 300 attendees and speakers participated in the event to hear about and discuss semiconductor material issues and trends that are critical to the entire semiconductor industry supply chain – now and in the future. The theme was Mission Critical Materials Keeping Pace with Chip Supply & Demand.

... to continue reading you must be subscribed