How to strengthen your supply chain

It goes without saying that the world we live in today is very much the digital age. Today we are more digitized and connected than ever before. Against this backdrop, digitization is one of the industrial gas industry’s biggest trends for 2022.

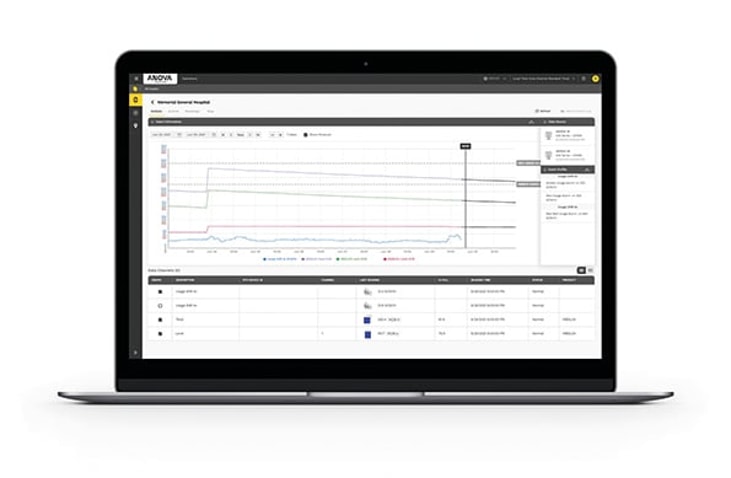

And it’s in this digital age where New Jersey-based Anova comes into play. A global leader in remote monitoring of industrial assets, providing Industrial Internet of Things (IIoT) solutions that enable improvements in efficiency, safety, service and profitability, the company has been leading digitization in the industrial gases market for over 30 years.

Formally DataOnline, Anova has built up long-standing relationships with six major global gases suppliers, more than two dozen regional gases producers on six continents and over 100 distributors in the North American independent gases and welding distribution community, plus a number of equipment suppliers and end-customers.

... to continue reading you must be subscribed