Inside Cryolor with Bertrand Masselot CEO

Like the best exclusive car manufacturers, French owned cryogenic storage manufacturer, Cryolor has a growing waiting list for its tanker vehicles with several shiny new models gleaming on the forecourt, awaiting collection. It may seem strange to compare the looming bulk of a Claire 3 cryogenic storage tanker with a classic car, but these gas transport units aspire to be the $quot;Mercedes$quot; tankers of the gas industry. Built to last, the tankers are engineered to high specifications, are safe, reliable and road-tested and come with a cradle-to-grave care policy that has gas industry customers returning time and again. So what is the inside story behind Cryolor’s runaway success?

Background

Cryolor will be celebrating 25 years of cryogenic tank and tanker manufacturing next year. Cryolor has over 50 years of manufacturing experience behind the company. The company was formed back in 1983, when its parent company- Air Liquide, merged its two tank and tanker manufacturing facilities into one to create an independent manufacturing company, Cryolor, and invested in the world’s first ultra modern, purpose-built tank facility (in Ennery, France).

The relationship between Cryolor and Air Liquide can be best described as a supplier-customer relationship in that Air Liquide is one of a number of important gas companies that purchase Cryolor products. A similar analogy is that of Cryostar, a fully owned specialised pump and expander manufacturer owned by BOC (now part of the Linde Group), an independent profit centre maintaining a totally independent structure and supplying many of Linde’s competitor plant manufacturers.

Air Liquide makes up just under half of Cryolor’s turnover. The remainder of Cryolor’s turnover is made up of all of the other industrial gas companies, including the major groups but also the independent players.

The Company

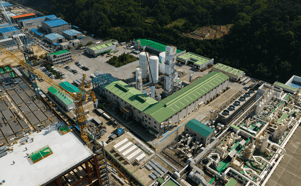

Cryolor estimates that it is one of the world’s leading supplier of quality cryogenic semi-trailers and among the top three in Europe for gas storage (static tanks). With almost every inch of the factory floor bursting with both new and refurbished stationary and trailer tanks or barrels, destined for customers worldwide, Cryolor is about to extend its 20,000m2 state-of-the-art automated production facility at Ennery, France by a further 7,000m2 in anticipation of another significant jump in turnover this year. The extension will make more space to meet increased demand for semi-trailers, large tanks and refurbishment operations, where Cryolor expects demand to remain healthy for years to come.

Cryolor exports 75 percent of its products from France, which include cryogenic storage tanks (air gases, thermosiphons, CO2 storage and LNG tanks) and distribution systems (semi trailers and truck mounts) along with engineered systems and services. Cryolor’s standard storage equipment ranges from 3,000 to 63,000 litres and accounts for 60 percent of turnover, while semi trailers and rigid tanks from 8,000 to 58,000 litres make up the remaining 30 percent of the business. The company does manufacture specially engineered tanks with capacities in excess of 100,000 litres. As well as atmospheric gases, the LNG business is also developing, and the company also manufactures equipment for specific applications, such as the underground hydrogen tanks commissioned by BOC for a fleet of hydrogen powered buses in London, oxygen tanks for submarines and electronic grade tanks.

The company insists on using the highest quality manufacturing materials and techniques. The tankers are fashioned entirely from stainless steel, including piping and valves, which enhances the fit between components by ensuring that all of these expand or contract to the same degree. $quot;This higher investment in initial build quality pays off over the product’s lifetime,$quot; Masselot argues. In addition the majority of production processes – including putting the tankers under vacuum, cleaning, coating and insulating – are highly automated giving a high degree of quality and standardisation, as well as speeding up construction.

A Bullish Market

In the 1990s, there were many tank manufacturing facilities operating, especially in Europe. $quot;The introduction of PED (the European Pressure Directive) in the late 1990s meant that we could reduce the number of manufacturing centres throughout Europe and become more efficient,$quot; Masselot says, $quot;but we are now entering a second phase.$quot; Several facilities closed during this period. $quot;However, the high growth in industrial gases around the world in the past 3-4 years has lead to a significant increase in demand for both tankers and tanks and demand now outstrips supply$quot;.

$quot;The key trend as we have seen over the last decade has clearly been a move towards increased demand for larger tanks and larger payload trailers,$quot; Masselot says. Cryolor’s average tank size has increased significantly, going from an average of 8,000 to 9,000 litres 10 years ago to about 17,000 to 18,000 in 2006/7. Trailer demand overall has also significantly increased with typical payload capacities being designed for 40 and 44 ton GVW (Gross Vehicle Weight). The recent onset of demand for LNG transportation had even lead to Cryolor manufacturing tankers up to 50t GVW (for Norway).

Global vision

One of the key growth drivers includes the need for industrial gas companies to reduce their total distribution costs by optimising distribution through fewer, but larger product deliveries. Europe’s fleet of 30 year old vehicles is due for renewal, and due to high petrol costs and taxes there are savings to be made from cutting the number of journeys by using ever-larger trailers. $quot;There’s a clear evolution in terms of the way the large industrial gas companies are dealing with these investments,$quot; says Masselot. $quot;In the past each business unit was self-sustainable in terms of investment,$quot; he continues. $quot;Today what we face is co-ordination from the European base if not the worldwide base for this type of investment. The procurement organisations now like to discuss global contracts.$quot;

Cryolor has been ideally positioned to capitalise on this growing demand, not least by offering asset management within European markets, and has more than doubled its turnover in the last four years and the company anticipates a further rise of 20 percent in 2007. The company is now producing five times the number of semi trailer units it did in 2000. Masselot says real evolution in trailer design, including centre of gravity and payload have paid off in the redesign, leading to the company’s Claire 3 tanker which arguably anticipated the next stage in customer needs and was fortunately released just prior to the big takeoff in trailer demand in the early 2000s. The Claire 3 has been pivotal in Cryolor’s regaining and significantly extending its market share.

To optimise existing assets, companies are increasingly refurbishing their tankers, which in some cases are resold in developing markets. This activity accounts for around ten percent of Cryolor’s business and is continuing to show increasing growth. A large percentage of the company’s business is in France and the rest of Western Europe (see diagram), but the company is also increasing market share in Eastern Europe and in Asia, where it was the first tank manufacturer to open an office in Singapore in 1993.

... to continue reading you must be subscribed