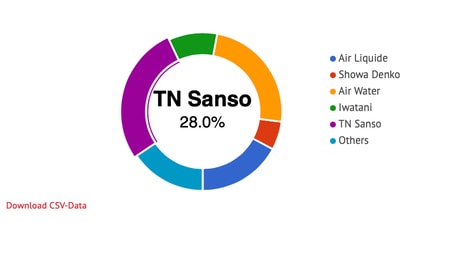

Country Focus: Latvia

The commercial industrial gas market in Latvia reached $43 million in 2014. This is up from $15 million in 2004, indicating an average annual growth rate of 11% p.a. for the decade. Growth has been relatively steady and the Latvian market represents the largest in the Baltic region.

The Economy

In 2014, Latvian GDP reached €21.5 billion, with average growth coming in at a comfortable 2.65%. This did represent a slowdown from the previous 3 years, where the economy was experiencing higher growth of between 4.1% and 5.3% p.a. during the post-recession period. Like many European countries, the global recession heavily impacted Latvia’s economy and lasted for three years. In 2009, GDP dropped by -18% p.a. With the help of a $10 billion bailout from the International Monetary Fund and the European Union recovery did ensue. Although, GDP is yet to reach the pre-recessionary levels of 2007.

Inflation has generally remained low, except for the years during the recession – with it reached an average annual peak of over 15%.

... to continue reading you must be subscribed