Country Focus: Poland

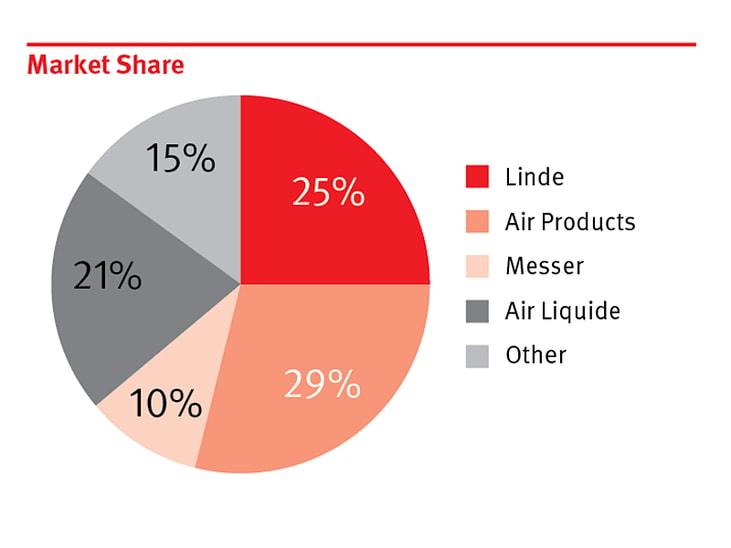

Generating $593m in 2013, up from $270m in 2003, the Polish industrial gas sector has expanded at an average growth rate of over 8% p.a. over the past decade (or over 5% p.a. if adjusted for inflation).

Joining the EU in 2004, Poland has benefited from access to significant European structural funds and the economy has successfully leveraged improved access to markets in neighbouring countries. Poland was, in fact, the only country in the EU to avoid recession in 2008-2009. Going forward, gasworld’s models indicate that the Polish industrial gas sector will continue to grow at between 5% to 7% p.a. within the 2014-2020 timeframe – largely in line with recorded inflation-adjusted growth.

So what’s in Poland?

... to continue reading you must be subscribed