Country Focus: Slovakia

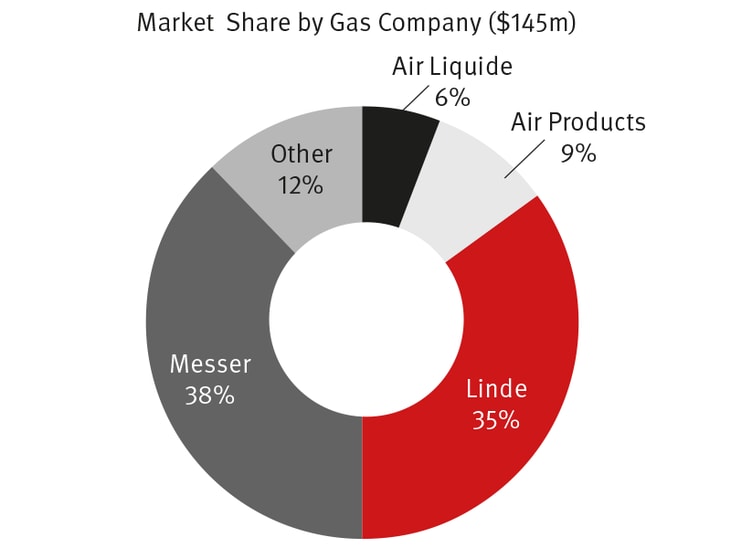

The commercial industrial gases market in Slovakia came to $145m in 2014. This is up from $69m in 2004, indicating an average growth rate of 7.7% p.a. over the decade.

... to continue reading you must be subscribed

The commercial industrial gases market in Slovakia came to $145m in 2014. This is up from $69m in 2004, indicating an average growth rate of 7.7% p.a. over the decade.

... to continue reading you must be subscribed

To access hundreds of features, subscribe today! At a time when the world is forced to go digital more than ever before just to stay connected, discover the in-depth content our subscribers receive every month by subscribing to gasworld.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |