Country Focus: Turkey

The commercial industrial gases market in Turkey is estimated to have generated revenues of $320 million in 2014. This is up from $104 million in 2004, indicating a rather impressive average annual growth rate of 11.9% for the decade.

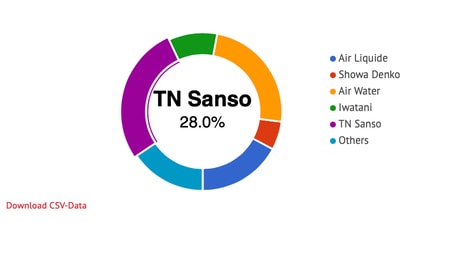

The leading industrial gas company is Habas, a local company with interests across many different industrial sectors. In recent years, Linde’s Turkish business has been gaining momentum and is occupying a growing share in the nation’s market. Beyond Linde, both Messer and Air Liquide have a significant presence in the country. The latter company in particular has, in very quick order, built up a sizeable onsite business.

... to continue reading you must be subscribed