Specialty gas market recovering in Asia-Pacific

The specialty gas market in the North Pacific Rim, including exports, is moving along well according to The Gas Review (TGR).

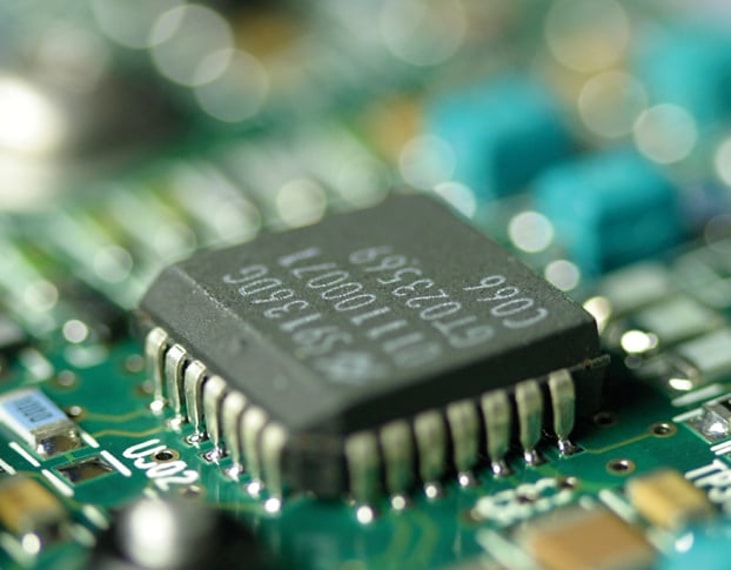

In addition to the thriving production of semiconductors in Taiwan and Korea, there are also new fabrication lines going into operation in China. While semiconductor ‘fabs’ in Japan are cutting back, existing fabrication lines have been doing well and as a result, the demand for specialty gas has been on the path to recovery.

Japan remains the world’s largest production area for specialty gas in terms of quality and quantity, says TGR.

In Korea, Taiwan and China, specialty gases used in large quantities (such as ammonia and nitrogen trifluoride and silane) are increasingly tending to be produced locally/domestically. In contrast to this, reliance on Japan is increasing for carbon hydride type gas such as carbon tetrafluoride, as well as chlorine and hydrogen chloride. In other words, TGR, notes, contradictory trends are in evidence.

... to continue reading you must be subscribed