Positioning for the long game

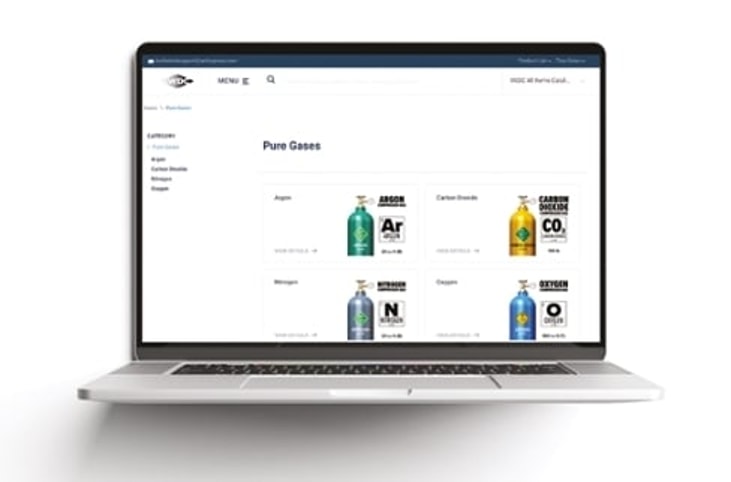

IWDC’s decision to stand up a Product Information Management (PIM) system was accelerated by the pandemic. Our PIM exists to supply product content supporting our co-op members’ on-line digital strategies. Our members, who are gas and welding distributors, are seeing the need to provide a good on-line B2B shopping experience to their existing customers. This is easier said than done. It requires connectivity between an enterprise resource planning (ERP) system and a robust e-store that contains well organized and enriched product content, supported by a PIM. A marathon, not a sprint.

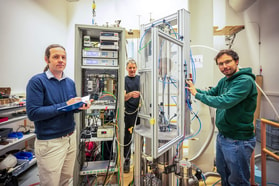

Every industry globally felt the shift towards a more virtual business environment. Zoom platforms and the like boomed. B2C e-commerce exploded. Traditional in-person sales and product delivery processes had to be adjusted or suspended to accommodate social distancing. Some businesses closed and many of those that remained open, restricted outside visitors. While impact was acute across retail consumer walk-in businesses, in our gases and welding arena, business carried on. Demand certainly dropped at end of first quarter (Q1) 2020, but it gradually recovered and has accelerated for most of 2021. Products still needed to be fabricated and facilities and general infrastructure still required repair and maintenance.

What changed or perhaps better said, what was exposed was the ability for B2B commerce to exist and in some cases flourish despite the pandemic’s impact on traditional processes. In a sense, business leaders, buyers and supply chain professionals became more comfortable letting their acceptance of B2C e-commerce experiences creep into our B2B world. The generational shift towards younger more technology receptive professionals started a fire and the pandemic poured on more fuel and oxygen.

... to continue reading you must be subscribed