Race to find North American sources

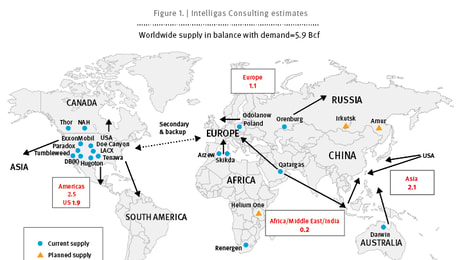

The global helium landscape is changing, but some companies are working to ensure helium supply stays close to home in North America.

Uncertainties around the reliability of overseas helium sources might not be a huge concern today, but there is worry that they could be in the future if North America becomes heavily dependent on importing helium from Russia and Qatar. With the winding down of the US Bureau of Land Management (BLM) helium system in the US, two of the world’s largest helium sources are set to be in Qatar and Russia. But geopolitical risks associated with those two locations are helping to generate investment and activity in securing more North American helium sources.

Exploration companies are stepping up efforts to increase the portfolio of smaller helium sources located in North America. Among the busiest is North American Helium Inc. (NAH), which earlier this year started up its $32-million Battle Creek helium plant near Consul, Saskatchewan, the largest helium purification facility in Canada, three months ahead of schedule and under budget. It is NAH’s second helium facility and, combined, the two plants have total helium productive capacity of approximately 60 million cubic feet per year (MMcf/y).

... to continue reading you must be subscribed