Refineries Driving Growth While Fuel Cells Keep the Market Interesting

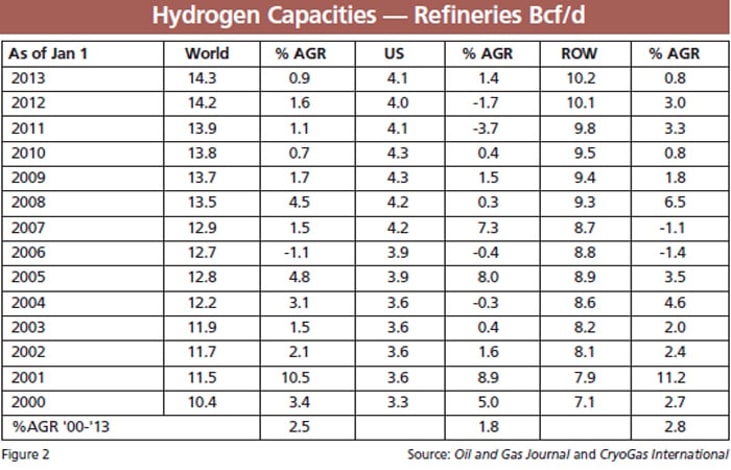

Hydrogen remains a solid growth platform for the industrial gas industry. Industrial gas companies continue to supply large quantities of hydrogen that are used by oil and gas refineries, basic and specialty chemical manufacturers, and food processors to what is known as the on-site pipeline or OSP business.

The greatest demand for OSP hydrogen is in the petroleum sector, where it is used to process the low sulfur fuels that are mandated by environmental regulations in North America and Europe. Industrial gas companies work with refiners to improve value through managing their energy systems so that they can more efficiently meet government fuel standards. Also driving growth for industrial gas companies is the shift toward sale of gas (SOG) in emerging economies and acquisitions/ replacement of aging steam methane reformers (SMRs). In this report, we bring readers up to date on the OSP business and the Merchant hydrogen business, which supplies small to medium hydrogen requirements. In the Merchant business fuel cell technology is of increasing importance.

On-site Supply

Most hydrogen is supplied via pipeline to large users. In the US, OSP represents 85 percent of hydrogen supply. SMR of natural gas remains the method of choice for on-purpose hydrogen production. This process is used on-site by most large users like refineries, fossil fuel processors, and ammonia producers, and it is used by the major gas companies to fill demand for OSP hydrogen. Increasingly, this method of production is becoming more important as larger users find by-product hydrogen insufficient.

Recent major changes in the US refining industry were prompted in part by a significant decline in the quality of imported crude oil and by increasing restrictions on the quality of finished products. Low quality (sour and heavy) oil requires more processing to meet clean air requirements. According to the US Energy Information Administration (EIA), “the average sulfur content of US crude oil imports increased from 0.9 percent in 1985 to 1.4 percent in 2005, and the slate of imports is expected to continue ‘souring’ in coming years. Crude oils are also becoming heavier and more corrosive than they were in the past, largely because fields with higher quality varieties were the first to be developed, and refiners’ preference for quality crudes has led to the depletion of those reserves over the past 100 years and reduced the market share of the light, sweet crude that remains.”

... to continue reading you must be subscribed