Regional markets – Focus on North Pacific Rim

When we profiled the North Pacific industrial gases business last year, we noted how in 2016 the region had for the first time in history eclipsed the size of the European market to become the second-largest industrial gas market in the world, at a value of almost $18bn.

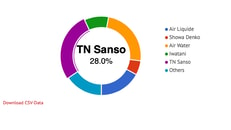

This had principally been due to the ongoing expansion of the Chinese market and relative strength of the Japanese Yen over the preceding 12 months. These trends have largely continued in the year since, with the Japan gases market stable and solid and China continuing to flourish. Added to which, the South Korean industrial gases market continues to expand in its own right.

Japan

... to continue reading you must be subscribed