Right first time – Making the right call in your fill plant investment

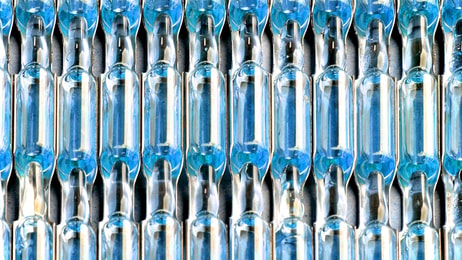

Cylinder filling plants represent the very baseline of the packaged gas business in the industrial gas industry, a segment that is worth approximately $29bn (2015) according to gasworld Business Intelligence. Without them, there would be a considerable hole in the distribution chain.

But they are complex sites and require a great deal of equipment to run smoothly. There are often separate areas for filling industrial, medical and ultra-high purity (UHP) gases depending on necessity. There are testing labs, analysis areas, distribution centres – not to mention all the tanks, cylinders, valves and extra equipment that needs a home on the site.

Fill plants represent a critical link in the supply chain for packaged gases and making the right investment at the right time can be tricky. What is the typical return on investment for fill plants? How can you design one effectively to prevent outgrowing it? Is there the option to add on to a plant in the future? These are all typical questions that are raised when first considering a fill plant investment.

... to continue reading you must be subscribed