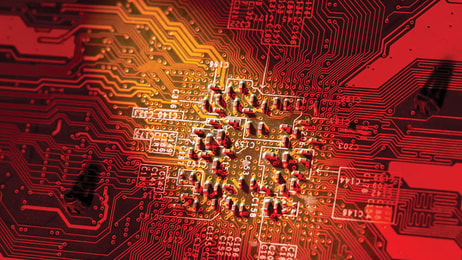

Semiconductor industry grows while gases and gas equipment rise like a phoenix

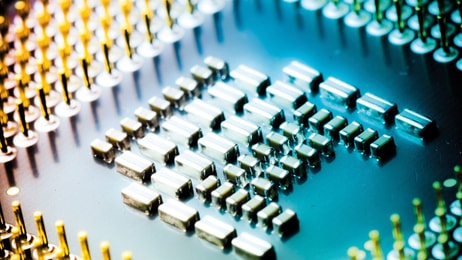

Toshiba has announced an investment of YEN 1.5 trillion into 3D-NAND flash memory devices, representing the largest capital investment ever made by a single corporation of Japan, The Gas Review revealed.

Plans for a new plant in Kitakami City have already stirred business for onsite nitrogen (N2) supply and gas alarm systems, showing active demand for gases and gas equipment.

Some people doubt the ability of Toshiba to make such an investment due to their large debt, but Toshiba’s profit ratio for memory devices business is estimated at 35% to 40%, and sales of more than YEN 1 trillion are expected this fiscal year. On paper, that means they would be able to repay their debt in one year. In essence, the more NAND flash memory devices they make, the more they can sell. The semiconductor market is speeding forward and the same goes for gases and gas devices.

... to continue reading you must be subscribed