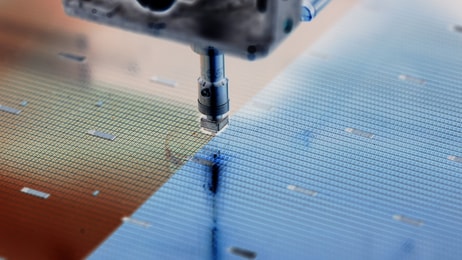

Semiconductor industry struggles

As major electronics and blue-chip companies report job cuts and dwindling sales, the effect on the industrial gas sector is uncertain.

In the latter part of 2001, a sharp downturn in the semiconductor industry resulted in a loss of revenue for a number of industrial gas companies.

As the global economic crisis grips the world in 2009, it seems that once again, the semiconductor industry is facing a substantial downturn, sparking renewed concerns for the gas providers.

... to continue reading you must be subscribed