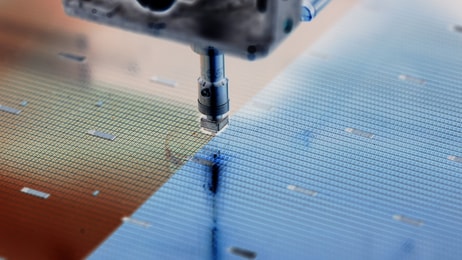

Semiconductors: A v-shaped recovery?

It’s easy to have been caught up with the headlines, hyperbole and optimism engulfing the electronics industry in recent years. The so-called ‘sunshine sectors’ of photovoltaics, solar cells and semiconductors have been cited as offering the gases business a ravenous growth driver for future gas consumption.

Yet the electronics sector practically fell off a cliff with the onset of recession in late 2008, stunting industrial gas & equipment demand and proving that even the most buoyant of growth drivers is not infallible.

So where do we stand now? Is the expected upswing in full progress? Here we are in our June issue, six months into the year and with a renewed sense of hope.

Powerful plunge

The sharp decline caused by the global crisis was well documented. But has the recovery been just as acute?

... to continue reading you must be subscribed