Solid revenue growth for Air Liquide in Q1 financials despite tough economic headwinds

In the first fiscal quarter of 2016, not even industrial gas giant, Air Liquide, could escape the impacts of the slowdown in the oil sector. But despite this and other external factors, such as lower exchange rates and energy prices, the French corporation still showed solid revenue growth, largely thanks to various M&A activity.

Overall group revenue in the first quarter of the fiscal year increased, reaching €3.9m ($4.4m) – up by 2.4% on a comparable basis but down by 3.1% on a reported basis – compared to the same period in 2015. Additionally, strong sales in its gas and services unit amounted to €3.55m ($4m), rising by 4.2% on a comparable basis.

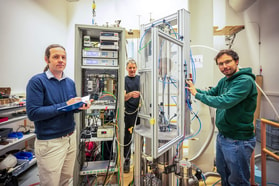

Thanks to production ramp-ups across various facilities in Germany, China and Saudi Arabia, its large industries unit showed an increase of 8.6% in revenue. The company particularly highlighted its Yanbu site in the Middle East (left), where hydrogen (H2) production volumes rose significantly.

... to continue reading you must be subscribed