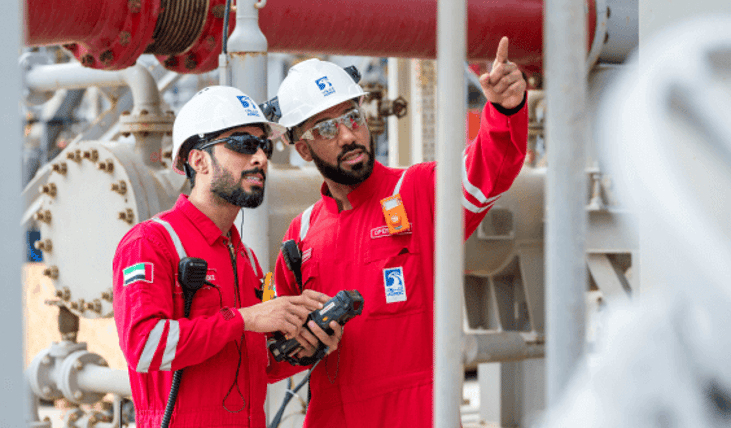

ADNOC Gas makes $13bn LNG commitment

ADNOC Gas is to invest $13 billion in domestic and international opportunities in the next five years and aims to more than double its liquefied natural gas (LNG) production capacity by 2028.

The $65 billion top 20 oil and gas company included the commitments in its 2023 results, in which it recorded a net income of $4.7 billion.

Dr. Sultan Ahmed Al Jaber, Chairman of ADNOC Gas – the integrated gas processing unit of ADNOC – said the investment will increases its EBITDA by up to 40% by 2029.

He said last year it made substantial investments, awarding contracts worth $4.9 billion to expand its processing capacity, which will provide additional sales volumes of up to 20%.

... to continue reading you must be subscribed