Air Products sees 9% sales increase during 2010

Today, the North American firm, Air Products, released details of a fruitful financial fourth quarter. The period saw continuing operating income of $294m, or diluted earnings per share (EPS) of $1.35.

John McGlade, Chairman, President and CEO for the company, stated, “We are very pleased by the excellent results and progress we made this year. In 2010, we emerged from the recession and delivered strong growth and productivity, which generated significant improvements in operating margin and return on capital. With this performance we are well positioned to achieve our 2011 goals. I want to thank our entire team for their hard work to deliver these results.”

The results exclude an after-tax charge of $22m, or $0.10 per share, following the tender offer for Airgas shares. Nevertheless reports reveal a successful quarter and, indeed, overall year for the Company.

Q4 witnessed revenues of $2,351m, which constituted a year-on-year 10% rise and 4% sequential increase. Similarly, underlying revenues were also up 8% and 3% respectively. Meanwhile, operating income rose to $402m, representing 22% yearly increase and 7% sequentially. Furthermore, in terms of EPS, Air Products enjoyed an 18% increase on Q4 of 2009.

Consequently, fiscal 2010 as a whole saw 9% increase in sales to $9,026m, a 25% rise in operating income to $1,485m, and diluted EPS up by 24% to $5.02 when compared with the prior year.

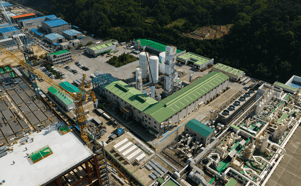

A segmented analysis reveals that the highest sales growth was experienced by Electronics and Performance Materials, at a rate of 20%. Tonnage Gases sales followed closely behind, increasing at a rate of 17%, while Merchant Gases and Equipment and Energy rose to a lesser extent; 12% and 5% respectively.

Looking ahead

McGlade predicts continued stable growth throughout 2011. He remarked, “We expect a continued, gradual global economic recovery in 2011. Our focus will be on loading our existing assets, winning new business and continuing to lower our costs.”

Air Products has provisionally forecast 2011 EPS in the range of $5.50 to $5.70 per share, equating to year-over-year earnings growth of 10% to 14%. The Firm anticipates capital spend in fiscal 2011 to reside between $1.5 and $1.7bn. McGlade concluded, “We remain committed to delivering our 2011 targets of double digit earnings growth, improving return on capital and achieving a 17% operating margin.”

... to continue reading you must be subscribed