Baker Hughes to make $13.6bn ‘counter bid’ for Chart Industries, claims report

Global energy technology company Baker Hughes is preparing a $13.6bn all-cash offer to buy US cryogenic equipment company Chart Industries, according to a Financial Times report.

The bid is lower than the $19bn proposed merger of equals between Chart Industries and Flowserve, announced in June, but would value Chart’s equity at $210 a share, a 22% premium to its market capitalisation, the report states.

The report claims the deal will be announced “in the coming days”. It also said the Flowserve deal “had been terminated”. Shares in Chart rose 16.5% to $200 in after-hours trading on Monday.

A deal would provide Baker Hughes with stronger links in growth sectors such as liquefied natural gas, nuclear energy and data centres – where year-to-date, its contract awards have topped $650m. Its adjusted net income for the second quarter was $623m.

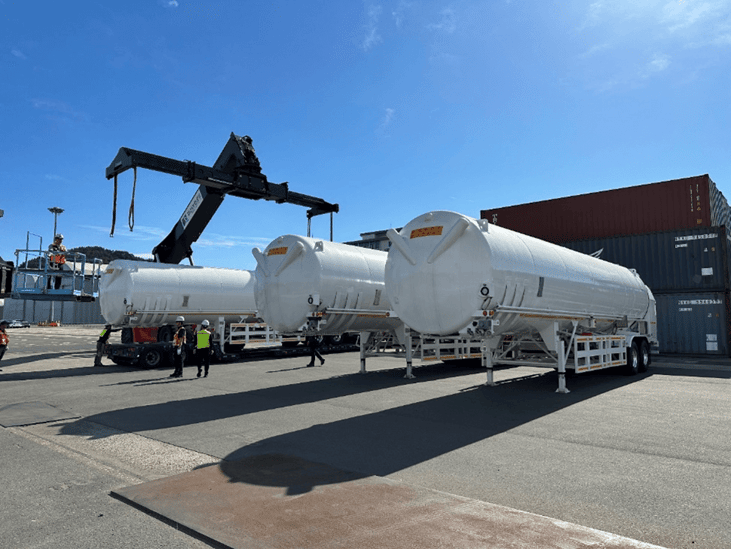

Chart is a leading provider of technology, equipment and services related to LNG, hydrogen, biogas and CO2 capture among other applications.

The Chart-Flowserve merger would have generated $300m of annual cost savings “with revenue upside” in the region of $8.8bn, the companies said upon announcement.

Both companies also expected to identify opportunities from electrification, the growth of nuclear, and global LNG capacity and utilisation, as well as the reshoring of critical manufacturing.

Upon completion, Jillian Evanko was set to step down as President and CEO of Chart, with Scott Rowe becoming CEO of the newly combined entity. The combined company, whose name was set to be announced at a later date, would be headquartered in Dallas, with a presence maintained in Atlanta and Houston.

The deal was expected to close in Q4 this year.

gasworld has contacted Baker Hughes and Chart Industries for comment.

What could the merger mean for smart tech solutions?

The merger activity follows a period of intense speculation about Chart’s future.

The Flowserve deal would have seen the companies combine a selection of their ‘smart’ technologies. This included Flowserve’s RedRaven, which helps to predict unplanned downtime, and Chart’s cloud-based 24/7 operational performance monitor service Uptime.

During a call, Scott Rowe, CEO of Flowserve, also spoke about the company’s interest in Chart’s Ventsim – a software suite used to design, simulate and control ventilation in underground mines and tunnels. This fits with Flowserve-owned Mogas, which makes valve coatings for the mining industry.

But what smart technologies could Baker Hughes bring to the table that might fill the gap? The company’s digital portfolio includes Cordant, an asset performance management platform that monitors equipment health and predicts failures, and iCenter, an edge‑to‑cloud service that provides real‑time diagnostics and remote monitoring.

Both could complement Uptime by creating a unified platform for asset health and predictive maintenance across an expanded installed base.

Baker Hughes also offers CarbonEdge, a digital platform for monitoring and managing carbon capture projects, along with AI‑powered analytics developed through partnerships with C3.ai and Microsoft.

Integrating these with Uptime and Ventsim could extend Chart’s capabilities beyond equipment monitoring to include subsurface modelling, CCUS oversight and advanced predictive analytics.