BOC: Fuel efficiency is a key step towards UK’s energy transition

As the global focus on decarbonisation intensifies, the growing hype around low- and zero-carbon fuels such as green hydrogen continues to capture the imagination and fuel discussion and debate around the elimination of fossil fuel-based energy, leading to the seemingly inevitable switch to renewable-based sources. But could this be distracting us from more immediate concerns? For successful and cost-effective fuel-switching to begin, industry must focus on the efficiency of our current energy sources and also continue to build infrastructure capable of handling the increased demand for low carbon fuels.

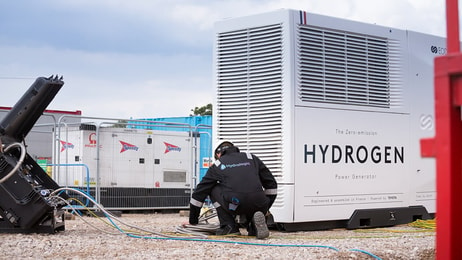

At least, that is the view of energy development expert Wayne Bridger, who is currently the UK Sales Manager for Decarbonisation and Hydrogen Applications at BOC UK & Ireland. Having overseen the company’s involvement in the recent BEIS Industrial Fuel Switching competition, Bridger was responsible for mobilising the largest hydrogen supply chain BOC has ever assembled.

The trials sought to demonstrate that energy intensive, hard-to-abate sectors could be decarbonised by switching production to hydrogen in high temperature processes such as glass, cement, lime and direct firing boiler applications.

... to continue reading you must be subscribed