FT Hydrogen Summit: Developing new hydrogen finance models to overcome offtake impasse

Clean hydrogen is not likely to become easier to finance through long-term offtake agreements being made, so another approach is needed. In Europe, this could include an institution being created to buy up any surplus hydrogen that’s being produced with some kind of transparent pricing attached.

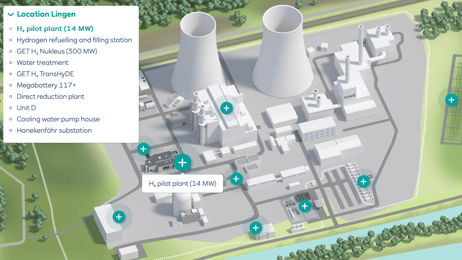

The idea was floated by Christian Stuckmann, Vice-President of Hydrogen for the state-owned German energy company Uniper, speaking as part of a panel debate on the bankability of clean hydrogen projects at the FT Hydrogen Summit 2025 in London.

“Europe needs to buy the hydrogen,” said Stuckmann. “There are mechanisms out there that it could adopt, such as the H2Global model. It is [an intervention] that is needed because long-term offtake agreements are not going to be signed. It is too complex a space for those commitments to be made.”

Stuckmann was speaking as part of a five-person panel, with moderation by Camilla Palladino of the Financial Times. Also on the panel were Sundus Cordelia Ramli, CCO of Power-to-X for Topsoe, Werner Lieberherr, CEO of Switzerland’s MorGen Energy, Patrick Gjelstrup Rosenquist, Head of New Energy for the Export and Investment Fund of Denmark, and Leslie Labruto of US non-profit the Environmental Defense Fund.

... to continue reading you must be subscribed