Investment builds in CCUS and hydrogen

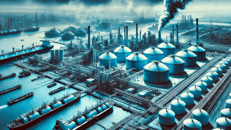

Around 20 commercial-scale carbon capture, utilisation and storage (CCUS) projects in seven countries reached FID in 2023 and more than 110 could be firmed up financially this year, according to the latest IEA World Energy Investment 2024 report.

If all projects are delivered on time, there will be a near 10-fold increase in CCUS investment by 2025, to $26bn – spurred by government funding and oil and gas company investment – but it remains ‘an open question’ whether all these projects will materialise, the report states.

The IEA’s positive outlook also extends to hydrogen, where electrolyser investment is expected to jump by more than 140% to $5bn this year, mainly as a result of capacity additions and inflation, with rises in equipment prices and financing costs.

Most capacity coming online is replacing existing uses (refining and chemicals), which are generally perceived as lower risk than new demand sources such as mobility and fuel conversions. China, Europe and the US are set to spearhead the investment charge although large-scale projects are underway in Saudi Arabia, Oman and Australia.

... to continue reading you must be subscribed