Linde bullish on sale-of-gas $7bn backlog despite Dow delay

Industrial gas major Linde says its project backlog remains strong at $7bn in sale-of-gas projects and is expected to grow by year-end, despite a delay to its $2bn clean hydrogen facility in Alberta, Canada.

Speaking on the company’s Q1 earnings call this week, CEO Sanjiv Lamba said the company expects to start up about $1bn-worth of projects from its backlog in the second half of the year.

“Despite everything you read in the news, we have a good pipeline of projects. The project win rate is looking particularly strong … given the circumstances,” he said, likely referring to wider macroeconomic turbulence and the Alberta delay.

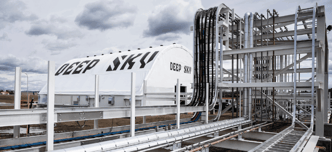

The Alberta clean hydrogen facility, located in Fort Saskatchewan, will supply what is expected to be the world’s first net-zero ethylene and derivatives complex, currently being built by US-based chemicals firm Dow.

... to continue reading you must be subscribed