NAH on the importance of non-hydrocarbon-based helium

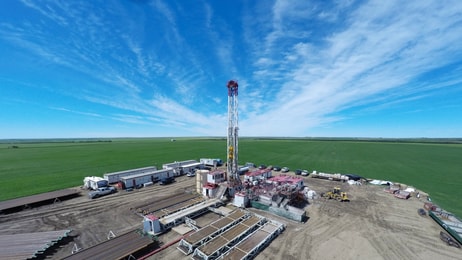

The development of green helium – produced from underground gas accumulations that contains very small amounts of hydrocarbons or CO2 – has become a more important topic of conversation among those in the marketplace.

For North American Helium (NAH), conversations surrounding non-hydrocarbon-based helium are the norm. The Canada-based company has been exclusively focused on developing new sources of reliable helium supply from non-hydrocarbon sources.

To some observers, this fresh take on helium production is the future of the industry, as currently nearly all the world’s helium is produced as a by-product of the processing of hydrocarbon-bearing gas at either natural gas processing facilities or LNG plants.

NAH and its Chairman and CEO Nick Snyder believe it is vital to develop new sustainable sources of helium supply in the US and Canada that are capable of reliable long-term production.

... to continue reading you must be subscribed