Surge of fresh LNG supply to flood market as uncertainty rises

Slow growth in demand for liquefied natural gas (LNG) combined with a significant rise in global export capacity until 2028 is poised to create an extended period of oversupply in the market.

That is the view of the most recent Global LNG Outlook by the Institute for Energy Economics and Financial Analysis (IEEFA).

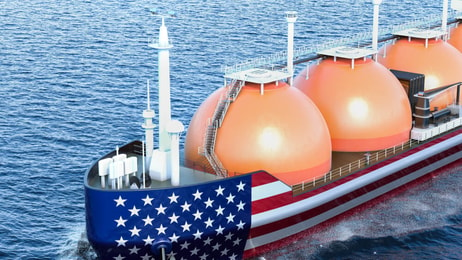

A surge of new export projects, notably in the US, is expected to boost global LNG export capacity by around 40% by 2028.

Despite a pause in authorisations for new export projects by the Department of Energy, US LNG export capacity is forecasted to grow by 80% during the same period.

... to continue reading you must be subscribed