TotalEnergies commissions FLNG in Germany

TotalEnergies has announced the launch of the Deutsche Ostsee LNG import terminal for liquefied natural gas (LNG).

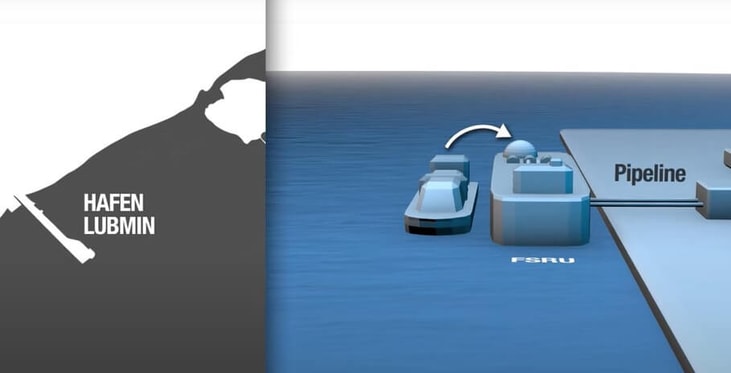

Operated by Deutsche ReGas and located in Lubmin on the German Baltic Sea coast, the site’s official inauguration will take place on January 14, attended by German Federal Chancellor Olaf Scholz. This project, to which TotalEnergies is contributing a floating storage and regasification unit (FSRU) and supplying LNG, will make the company one of Germany’s main LNG suppliers.

In December, TotalEnergies delivered the Neptune – one of the Company’s two floating storage and regasification units – to Deutsche ReGas. The vessel has an annual regasification capacity of 5 bcm of gas, enough to cover about 5% of German demand.

Following Deutsche ReGas’s open season procedure, in October, TotalEnergies also contracted regasification capacity of 2.6bcm of gas per year and began to deliver LNG from its global integrated portfolio to the Lubmin terminal. The planned regasification capacity of the German Baltic LNG terminal will amount to a total of up to 13.5bcm of natural gas per year from summer 2024.

... to continue reading you must be subscribed