Trade associations challenge 45V tax credit over emissions calculation concerns

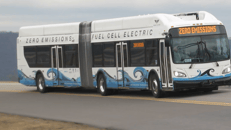

Several trade associations have raised concerns surrounding the 45V clean hydrogen production tax credit, stating that it could prevent investment in clean hydrogen.

As it stands, the proposed regulations for 45V require clean hydrogen producers using natural gas as a feedstock to input a fixed upstream emissions rate based on a national average.

However, within the 45VH2-GREET model, which is tailed for assessing hydrogen production pathways, the upstream emissions rate is “background” data that cannot be altered by a producer.

It says that maintaining upstream methane emissions in blue hydrogen as background data could put major projects in jeopardy, which could result in less clean hydrogen.

... to continue reading you must be subscribed