The 2011 Electronics Market Report

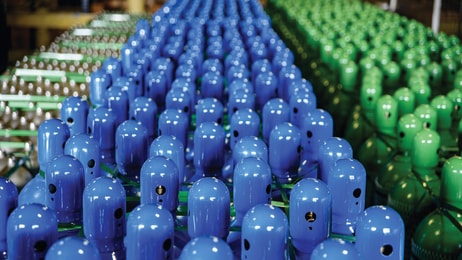

Industrial gas companies support the two distinct market segments of the semiconductor industry—silicon and compound—with many of their product offerings serving both segments. The industrial gas industry produces a variety of specialty and tonnage gases, specialty and bulk chemicals, and services and equipment for the manufacture of silicon and compound semiconductors, displays (LCDs, etc.), and closely related photovoltaic systems and devices.

It also works closely with electronics manufacturers to identify and supply diverse and sophisticated materials and equipment used in virtually every manufacturing process to produce: critical electronics components; integrated circuits (IC, also known as silicon chips or chips); and related products for both the semiconductor and the photovoltaics (PV, also known as solar) markets. Industrial gas products include bulk gases like nitrogen, argon, helium, and hydrogen as well as highly specialized electronic gases and chemicals like nitrogen trifluoride (NF3), silane (SiH4), phosphine, and trimethylsilane (3MS). In this 2011 electronics market update, we look at how industrial gas players and related materials suppliers fared within both the semiconductor and PV segments.

In addition to the materials, gases, and gaseous chemicals that industrial gas (IG) players produce and transport to semiconductor and photovoltaic customers as noted above, they also produce specialized equipment to support material and gas applications in these sectors and are key suppliers to the related glass manufacturing that is critical in the PV sector. CryoGas International estimates that the industrial gas industry’s portion of the total global semiconductor and PV market in 2011 was about $6.9 billion, a growth of almost eight percent per year from 2009, but only 1.1 percent per year from 2008, indicating that the IG electronics business is only just recovering from pre-recession levels. IG electronics revenues represent about 10 percent of the total worldwide Industrial Gas and Related Materials market of $70 billion. (The IG industry experienced a significant decline in its semiconductor and PV market of about 10 percent from 2008 to 2009 due to the global economic recession. (See “2009 Electronics Market Report,” CryoGas, June 2010, p. 26.)

In addition to the materials, gases, and gaseous chemicals that industrial gas (IG) players produce and transport to semiconductor and photovoltaic customers as noted above, they also produce specialized equipment to support material and gas applications in these sectors and are key suppliers to the related glass manufacturing that is critical in the PV sector.

Most of the electronics recovery growth occurred in 2010 as 2011 saw slowing growth in the last half, reflecting a decline in consumer spending on electronics; the decline in spending reflected the slowing global economy. While worldwide real gross domestic product (GDP) grew 3.0 in 2010, it pulled back to 1.7 percent in 2011. Estimates from the World Bank project a growth of 2.5 in 2012, and 3.1 in 2013 (aggregate growth rates are calculated using constant 2005 US dollar GDP weights). Slower growth is already visible in weakening global trade and commodity prices. Today, the main drag on global growth is coming from high-income countries, whose economies contracted by over 3.0 percent at the height of the recession in 2009. The World Bank’s growth forecast for high-income countries in 2012 is just 1.4 percent (-0.3 percent for the Euro Area).

... to continue reading you must be subscribed