The US Merchant Carbon Dioxide Market Report

Within the US merchant carbon dioxide (CO2) market, changes to patterns in CO2 sourcing and changes in demand regionally, continued to reshape the business in 2009 as they have over the past five-plus years (see “Carbon Dioxide — A Market on the Move,” CGI, May 2009).

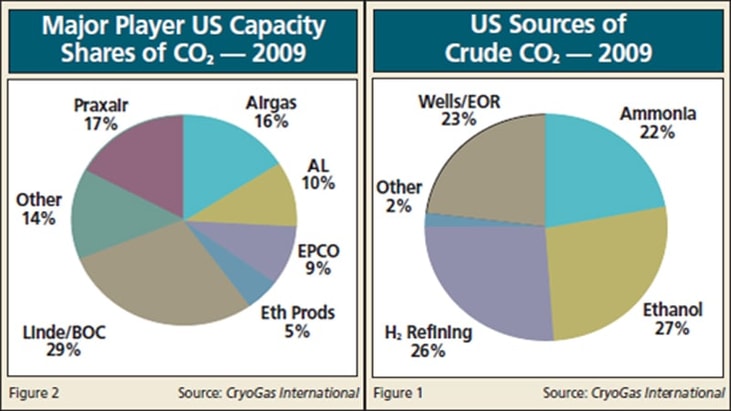

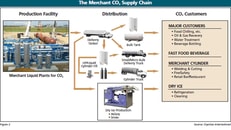

The CO2 business is comprised of industrial gas companies and specialized CO2 producers and distributors that supply merchant liquid and dry ice to a wide variety of CO2 markets including food, welding and cutting, and oil and gas. A variety of factors outside the CO2 market effect both demand for CO2 and its sourcing. For example, as prices for natural gas (NG) fall, CO2 sourced from NG-fueled ammonia plants becomes more cost-effective. In addition, falling natural gas prices encourage some energy companies to transfer their attention from NG to oil, and demand for supply of pipeline CO2 for Enhanced Oil Recovery (EOR) improves. Commodity markets also impact CO2 sourcing. The price of corn, a feedstock choice for many ethanol plants that represent a major source of by-product CO2, is volatile and ethanol producers are moving to cellulosic and algae-based biofuel feedstocks that have more stable pricing. However, it is unclear how many of these newer biofuel plants will recover CO2 for the merchant market. Political considerations also influence CO2 sourcing. Environmental concerns and proposed carbon trading schemes have led many energy producers to evaluate the feasibility of recovering CO2 from gasification processes for environmental reasons and monetizing the recovered CO2 by selling it into the EOR market to recoup investment costs.

Merchant CO2 Demand

About two-thirds of merchant CO2 consumption in the US is used in production, processing, and packaging in food and beverage markets. In 2009, the food and beverage market grew just over two percent. The other one-third of merchant CO2 in the US is consumed in a number of industrial segments such as welding and cutting, chemical process industry, and oil and gas well workovers. Consumption of CO2 in industrial and oil patch applications has been growing steadily since 2000.

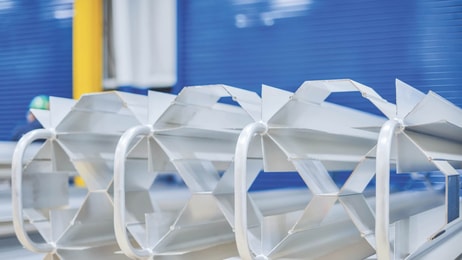

Dry ice is another key part of the CO2 industry, where it is used as a refrigerant and as pelletized dry ice for blast cleaning. CO2 is also used for chilling and freezing applications in the food industry, but here demand has declined, with CO2 refrigeration losing ground to the more cost-efficient mechanical refrigeration. When energy prices are high, CO2 is also used for relatively expensive mining processes, like well workovers. As energy prices fall, however, demand for CO2 in these applications tapers off.

... to continue reading you must be subscribed