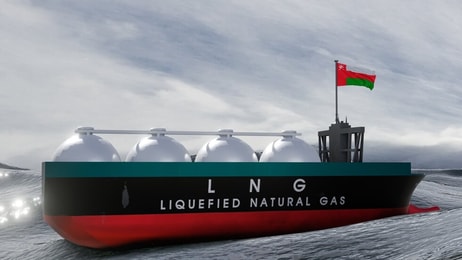

bp profits halve despite LNG and biogas growth

bp’s profits halved to $13.8bn in 2023 on the back of lower energy prices though resilience in the gas sector helped support the multinational energy group’s overall business.

Its LNG portfolio rose 4 Mtpa to 23 Mtpa, biogas supply and production volumes increased 80% and 18% respectively, while its hydrogen pipeline grew to 2.9 Mtpa, up from 1.8 Mtpa in 2022.

Yet gas wasn’t immune to wider commercial pressures, with total adjusted EBITDA for gas and low-carbon energy totalling $14.76bn in 2023, down from $21.07bn in 2022, while in the fourth quarter 2023 it totalled $3.4bn, down from $4.5bn year-on-year. Overall fourth quarter profit totalled $3bn.

Murray Auchincloss, hosting bp’s first results as CEO, said 2023 was a year of strong operational performance with real momentum in delivery across the business.

... to continue reading you must be subscribed