The Baird/CryoGas Industrial Distributor Survey

After a pretty solid 2011 among the major industrial gas companies, the expectation seems to be for continued steady growth in the US (consistent with results of the 4Q11 Baird/CryoGas Survey as summarized on the previous page), ongoing growth and new investment in emerging markets, and relatively lower results in Europe due to the ongoing recession there.

With backlogs growing and capital expenditure plans accelerating, the growth and return outlook beyond 2012 continues to look favorable, as well. On the M&A front, survey responses indicate that the appetite for acquisitions remains high among the major US consolidators Airgas, Praxair, and MATHESON, and there is perhaps some renewed interest from select private-equity players, such as CI Capital Partners.

2011 Results—2012 Outlook by Company

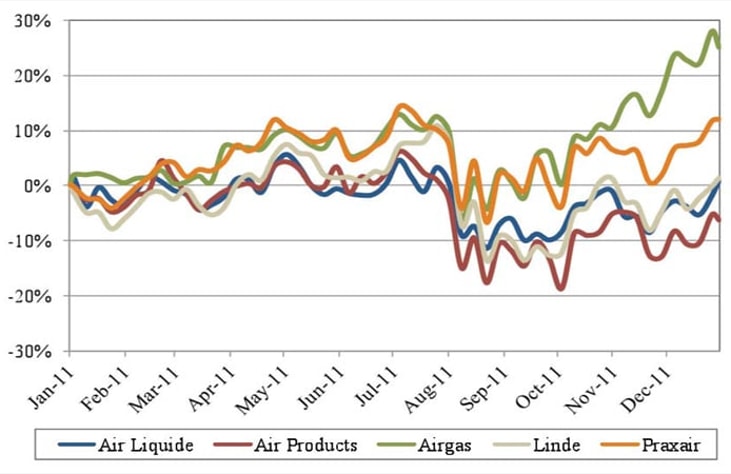

After successfully defending against a hostile takeover attempt early in the year, Airgas registered the best stock price performance of the group of industrial gas companies we follow— increasing by 26.5 percent in 2011. Despite absorbing costs related to the ongoing SAP implementation, the company was able to grow earnings per share by more than 22 percent via low-teens Hardgoods growth and upper single-digit Gas & Rent. Returns on capital increased, return on equity was boosted by an aggressive $300 million share repurchase mid-year, and EBITDA margins are approaching targeted 18.0-18.5 percent levels. Looking to 2012, Airgas sees modest, steady growth, consistent with results from our 4Q11 survey and most likely more than enough to comfortably exceed the C2012 EPS target of $4.20.

Despite absorbing costs related to the ongoing SAP implementation, the company was able to grow earnings per share by more than 22 percent via low-teens Hardgoods growth and upper single-digit Gas & Rent.

Praxair had another in a long history of solid stock price performance years, increasing 14.5 percent in 2011. Performance was driven by 14.6 percent earnings per share growth on revenue growth of 11.2 percent. EPS of $5.43 exceeded the high end of the $5.20–$5.40 guidance management provided in January of 2011. After-tax return on capital increased to 14.7 percent and is approaching targeted 15 percent-plus levels. Praxair completed a $1.5 billion share repurchase program and announced another $1.5 billion authorization expected to be completed by 2013, while still increasing 2012 capital expenditures by 17–34 percent over 2011. Management expects 4–7 percent revenue growth and 5–9 percent EPS growth in 2012—solid growth, considering recent currency exchange rates would imply a five percent year-to-year reduction in revenue and EPS.

... to continue reading you must be subscribed